1098-T Tuition Statements and FAQs

The Blinn College District is subject to Internal Revenue Service (IRS) reporting requirements and must report for each student enrolled for whom a reportable transaction was made during the tax year. The 1098-T form reports payments received for qualified tuition and related expenses for the calendar year (January 1st through December 31st).

The IRS requires a valid Social Security Number (SSN) or Individual Tax Identification Number (ITIN) on all 1098-T forms. If we do not have your SSN or ITIN on file, we are required by the IRS to attempt to obtain it from you. If you have been notified that we do not have your SSN or ITIN number, you must fill out the Social Security Update Form. You can access the form here: Social Security Update Form

If we do not have your SSN or ITIN on file, it will not be included on your 1098-T tax form.

The IRS may fine you if you fail to provide SSN or ITIN.

PLEASE NOTE: The following general information should not be taken as tax or legal advice. Blinn College District cannot provide tax guidance. For tax preparation advice, please consult a tax professional.

Form 1098-T is an annual IRS form provided to students to report student related educational payments. The form summarizes payments towards qualified tuition and fees for the calendar year (January 1 through December 31). This information may be used for student eligibility for tax credits or other educational tax benefits.

Receiving the 1098-T form does not mean you necessarily qualify for a tax credit. The taxpayer is responsible for determining eligibility for educational tax benefits and how to calculate. These benefits are explained in detail in IRS Publication 970. If you have questions about eligibility or how to calculate your education tax credit, you should consult a tax professional or refer to the IRS website. Blinn College District cannot advise on tax matters.

When 1098-Ts are released, they will be available and accessible through the Heartland ECSI web portal. Students who would like to access an electronic copy of their 1098-T statement, or who have questions about how to receive an electronic copy of their 1098-T statement should go to the Heartland ECSI website

There are three steps to access your 1098-T tax form.

Step 1: Create a Profile

You will need to create a profile to connect an account and access your 1098-T tax form. See Create a Profile below for step-by-step instructions.

If you already have a profile, you can skip Step 1 and go directly to Step 2 to connect your tax form account to your existing profile.

Step 2: Sign In To Your Profile

Now that you have created your profile, you will need to sign in to the profile to complete step 3 of this process. See Sign In To Your Profile for step-by-step instructions.

Step 3: Connect an Account

Once you have created a profile, you will need to connect your tax form account to your profile. See Connect An Account for step-by-step instructions.

IMPORTANT! You will need your Heartland Key to connect your account.

If you signed up to receive your tax form electronically (completed the electronic consent application) prior to receiving your tax form, your Heartland Key will be located in the email communication you received from ECSI on behalf of your school. If you cannot locate this email, you will need to call our Contact Center at (866) 428-1098 to get your Heartland Key over the phone or have the email resent to you.

If you received a printed tax form that was mailed to your address, you will need to call our Contact Center at (866) 428-1098. Once you have verified your identity, we can either provide your Heartland Key over the phone or we can send an email with your Heartland Key to you.

Create A Profile

To create a profile, click on the Sign In | Register link in the top right of the web page. Go to the Register and Create A New Profile area on the right side of the page. Follow the instructions below.

Step 1: Think of the username you want to use and enter it in the Username field. Then think of a password you want to use and enter it in the Password field. You will need to re-enter the Password in the Confirm Password field. Click on the Continue button.

Step 2: Enter your contact information including your first and last name, date of birth, phone number, and email address. Click on the Continue button.

Step 3: Enter your address including street, city, state and zip code. Click on the Continue button.

Step 4: Select three (3) security questions and enter your security answers. Check the reCAPTCHA checkbox and click on the Save Your Profile button.

When your profile is successfully created, you will be returned to the Sign In page.

Sign In To Your Profile

To sign in to your profile, click on the Sign In | Register link in the top right of the web page. Go to the Sign In To An Existing Profile area on the left side of the page. Follow the instructions below.

Step 1: Enter your username and password. Click on the Continue button.

Step 2: Choose how you want to receive your verification code. Check the reCAPTCHA checkbox and click on the Send Verification Code button.

NOTE: You can receive the code via text if you entered a mobile number for your profile. Otherwise, you can receive your verification code via automated call or email.

Step 3: Enter the verification code that you received in the Verification Code field. Click on the Continue button.

When you have successfully completed the Sign In process, you will be directed to the Your School Accounts page. This is where you will need to connect your tax form account to your profile to view or print your 1098-T(s).

Connect An Account

To connect an account to your profile, use the following steps.

IMPORTANT! You will need your Heartland Key to connect your account.

Step 1: Click on the Connect An Account tile from the Your School Accounts page.

Step 2: On the right side of the page, enter your Heartland Key and click the Continue button.

If ECSI’s information matches the information in your profile, your tax form account will be connected to your profile. If ECSI’s information only partially matches your information in your profile, you will be prompted to enter additional points of verification. If ECSI’s information does not match the information in your profile, you will be directed to call our Contact Center at (866) 428-1098.

If you signed up to receive your tax form electronically (completed the electronic consent application) prior to receiving your tax form, your Heartland Key will be located in the email communication you received from ECSI on behalf of your school. If you cannot locate this email, you will need to call our Contact Center at (866) 428-1098 to get your Heartland Key over the phone or have the email resent to you.

If you received a printed tax form that was mailed to your address, you will need to call our Contact Center at (866) 428-1098. Once you have verified your identity, we can either provide your Heartland Key over the phone or we can send an email with your Heartland Key to you.

View Your 1098-T Tax Information Online

After you have created a profile, signed in to your profile, and connected your tax form account, you can view your 1098-T tax information.

From the Your School Accounts page, click on the tile/card that is displayed for the school. Then, click on the View Account button. Your tax form information will be displayed on the page.

View Or Print Your 1098-T Tax Form

After you have created a profile, signed in to your profile, and connected your tax form account, you can view your 1098-T tax form.

From the Your School Accounts page, click on the tile/card that is displayed for the school. Then, click on the View Account button. Your tax form information will be displayed on the page.

IMPORTANT: You must turn off pop-up blockers to view your form in the IRS Form 1098-T format. To turn off your pop-up blockers, visit the Tools or Settings menu for your specific browser.

Click on the View/Print Statement link to the right of the tax form information section. Your form will be presented in the IRS Form 1098-T format in your browser’s standard print dialogue box. Follow the print instructions for your particular browser to print the form to your local printer.

If you need additional assistance accessing your 1098-T tax form, please contact Heartland ECSI at 866-428-1098.

1098-Ts will be mailed by January 31st. If you opted to receive your 1098-T electronically, it will be emailed to you the last week of January.

The IRS requires a valid Social Security Number (SSN) or Individual Tax Identification Number (ITIN) on all 1098-T forms. If we do not have your SSN or ITIN on file, we are required by the IRS to attempt to obtain it from you. If you have been notified that we do not have your SSN or ITIN number, you must fill out the Social Security Update Form. You can access the form here:

If we do not have your SSN or ITIN on file, it will not be included on your 1098-T tax form.

The IRS may fine you if you fail to provide SSN or ITIN.

Yes. To give consent to receive your 1098-T form electronically, click on the link below and follow the simple instructions to sign up. Electronic consent must be received by January 1 in order to receive the 1098-T form electronically. Otherwise, the form will be mailed to the address on file as of December 31.

- Visit Heartland ECSI to fill out the consent form

- Follow the step-by-step instructions on the web form

- Check the box and click submit

Qualified expenses are amounts paid for tuition, fees, and other related expenses for an eligible student that are required for enrollment or attendance at an eligible educational institution. Eligible expenses also include student activity fees you are required to pay to enroll in or attend the school.

Expenses for books, supplies and equipment may be considered qualified educational expenses in some circumstances. Only those expenses required to enroll, or attend are included on the 1098-T form.

The following are not qualified education expenses:

- Room and board

- Insurance or medical expenses (including student health fees)

- Transportation

- Personal, living, or family expenses

In certain situations, a 1098-T form may not have been generated for you:

- Students who take courses for which no academic credit is offered will not receive a 1098-T form even if the student is otherwise entered in a degree program.

- Non-resident alien students (unless specifically requested by the student).

- Students whose qualified tuition and related expenses are entirely waived or paid by scholarships, grants, outside resources, or other third parties such as employer or federal/state government agency.

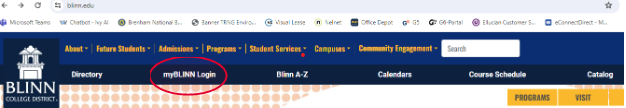

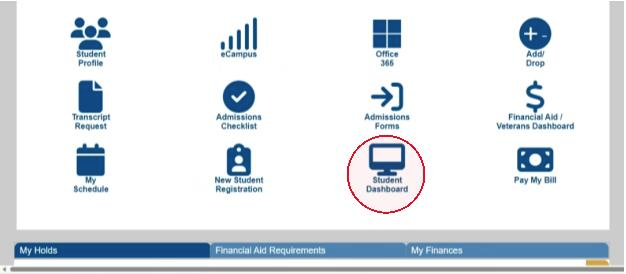

- On the student landing page, select Student Dashboard:

· On the student landing page, select Student Dashboard.

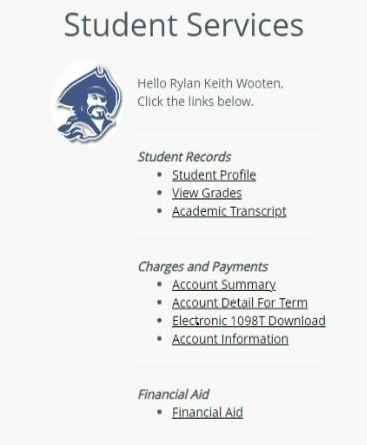

- From the Student Services menu, under Charges and Payments, choose Account Summary:

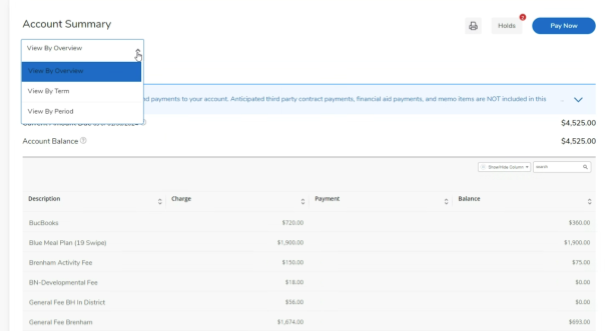

- You may view account summary by overview, by term or by period:

- For tax specific questions, please contact the Internal Revenue Service or your personal tax advisor for further assistance.

- If you require assistance accessing your 1098-T form, Heartland ECSI maintains a Live Chat feature that is easily accessible on the Heartland ECSI webpage.

- For other questions, email 1098t@blinn.edu.